Required criteria before gastric bypass, lap band or other procedures are approved for coverage. You may be able to get part of the costs paid for by insurance even if weight loss surgery isn’t covered.

Getting your insurance to pay for weight loss surgery most major insurance companies will require:

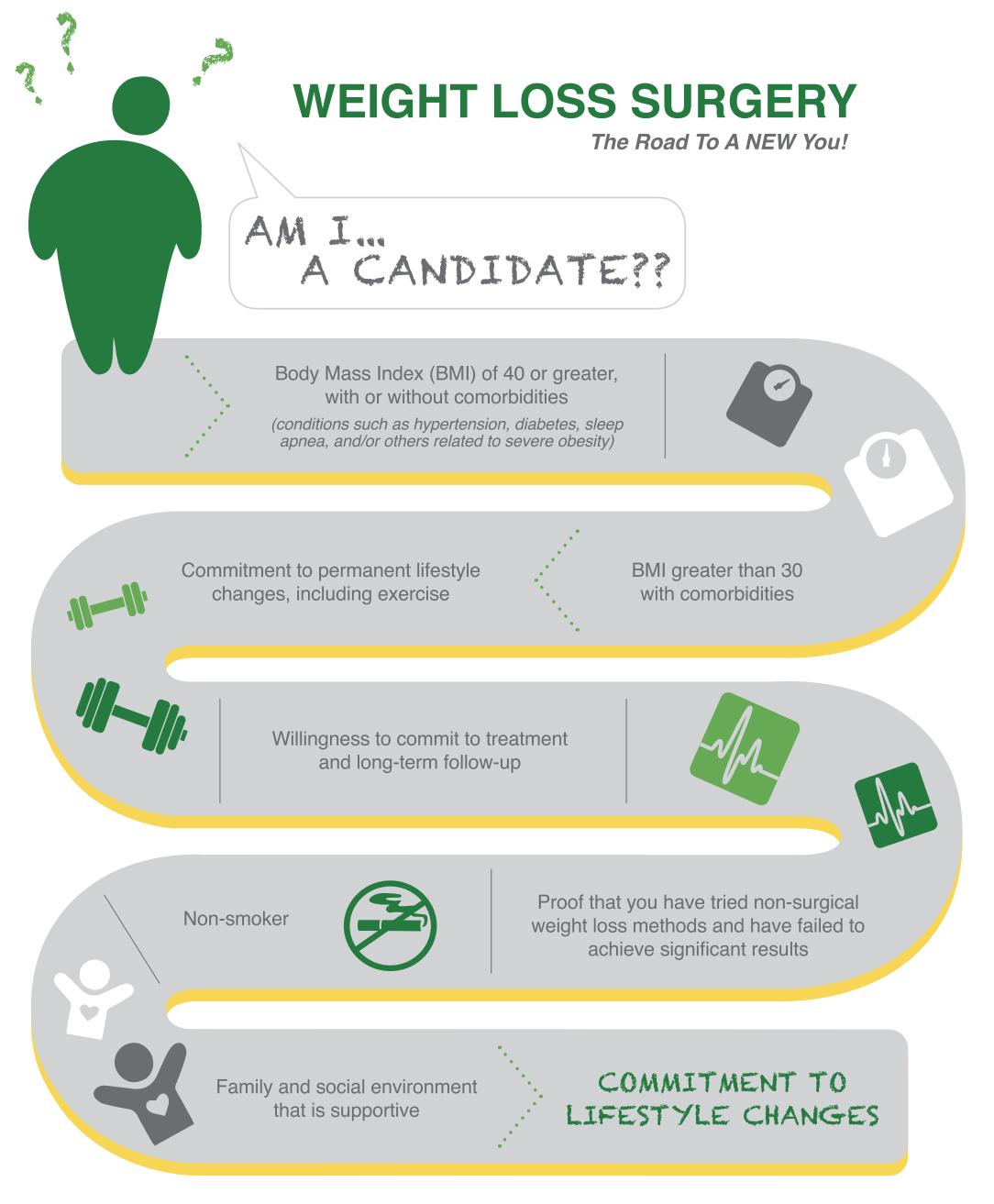

How to get insurance to pay for weight loss surgery. Be over the age of 18 have a bmi of 40 or greater, or have a bmi of 35 or greater with a comorbidity such as diabetes or hypertension A secured medical loan is a loan you guarantee with collateral, such as your home or car. Medicare covers weight loss surgery;

Speak to your hr manager: These are the general baseline costs for the most common plastic surgeries to loose skin after weight loss, according to the american society of plastic surgeons: If they cover bariatric surgery, that is great news!

In the meantime, patients with exclusions essentially have two options: Since my bariatric solutions has chosen to. We will work closely with them to determine your benefits during your initial consultation appointment.

At alabama surgical associates, we are committed to helping you attain your weight loss goals and we offer some of the lowest pricing on bariatric surgery in the nation as part of our dedication to putting better health within reach. Use our bmi calculator to see if you qualify! During that time, medicaid will review your.

Does medicaid cover weight loss surgery? Since the panniculectomy is not typically seen as a cosmetic surgery, your. Generally speaking, the average cost for a gastric bypass ranges from $18,000 to $25,000, while the adjustable gastric banding surgery costs anywhere from $17,000 to $30,000.

Some insurance companies require more than 2 comorbidities before approving surgery. Which weight loss surgeries are covered. Proof that surgery or medical intervention is medically necessary.

So before getting too involved, spend time determining if your insurance will cover weight loss surgery. Pregnancy or significant weight fluctuations can create a pocket of. However, wait times for medicaid approval can take five months or more.

We include the following important information for each insurance company listed: Below is a list of common comorbidities of morbid obesity that are accepted by most major insurance carriers. How to appeal a health insurance company denial.

The first step to determining your coverage for weight loss surgery is to contact your insurance company directly. Medicaid covers weight loss surgery (but not all surgeons accept medicaid) if your insurance policy covers weight loss surgery, insurance will only pay for it if: Health insurance and weight loss surgery.

The list below is organized by insurance company. This is a reasonable request and is often honored, especially if negotiated in advance. How to pay for weight loss surgery:

Written by oc staff june 4, 2020. Get this agreement in writing. If you have a health insurance policy through work and you’re wondering how to get weight loss surgery approved, discuss your options with an hr representative.

Consider self paying for surgery If your insurance does not cover bariatric surgery, do not get discouraged. Additionally, to qualify for insurance coverage of your bariatric surgery, you must meet some specific metrics, including:

Insurance companies typically require at least 2 comorbidities and a bmi of 35 or greater in order to cover weight loss surgery. According to duke health, you will likely have to meet some or all of the following criteria in order to get weight loss surgery covered by your insurance: Many of our patients have had success financing their weight loss surgeries through these partners.

Will insurance cover a panniculectomy? While my bariatric solutions does not offer in house payment plans, we do work with several medical financing companies. If your health insurer denies the request for weight loss surgery, you can appeal the decision.

You will need to build a strong case that your surgery is medically necessary, however. Counseling or therapy for obesity, including weight loss programs. You may be able to get part of the costs paid for by insurance even if weight loss surgery isn’t covered.

Getting your insurance to pay for weight loss surgery most major insurance companies will require: Yes, medicaid covers surgery in most states. According to bariatric surgery source, one common source of financing is a secured medical loan.

If lap band fills are covered after surgery. The surgery is expected to restore or improve the functional impairment. Some weight loss surgery centers can help you get a loan that you can repay over a number of years.

The average cost of gastric bypass surgery is $23,000, the average cost of lap band is $14,500, and the average cost of sleeve gastrectomy surgery is $14,900. Medicare will pay for abdominoplasty (or a tummy tuck) after weight loss surgery if it is deemed medically necessary due to excess skin that causes rashes or infections. It’s all about how your doctor and hospital submit your claims to your insurance company.

Weight loss surgery is predominantly performed on middle to upper class patients. An additional seven states cover nutritional counseling or. To get insurance to cover your weight loss surgery:

Note, after significant weight loss, unrelated to bariatric surgery, in addition to the criteria listed above, there must be documentation that a stable weight has been maintained for six months. We partner with independent medical lenders to facilitate affordable monthly payment plans. Required criteria before gastric bypass, lap band or other procedures are approved for coverage.

Your employer may be willing to offer a plan. Thankfully, there are six financing options available to help make the cost more manageable. If you are paying for surgery out of pocket, this is the person that you ask to allow you to pay the same rate that insurance companies have negotiated for the same procedure.