Aetna, anthem blue cross blue shield, cigna, oscar, tricare and united. Only a few years ago the lap band procedure was considered experimental and not covered by most insurance companies.

Ideally, fluctuations could interfere with the outcome of the procedure.

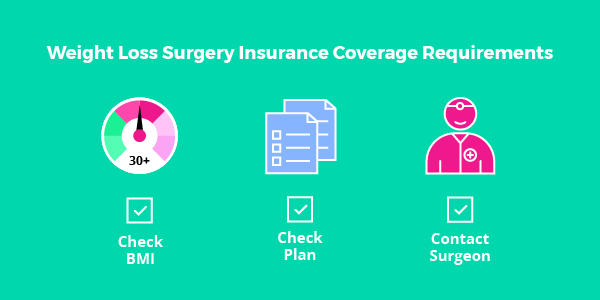

Weight loss surgery insurance coverage. Most people considering weight loss surgery cannot pay $20,000 to lose weight. You may be responsible for some or. What insurance covers weight loss surgery?

Aetna, anthem blue cross blue shield, cigna, oscar, tricare and united. The same goes for situations in which your insurance company covers weight loss. Medicare covers weight loss surgery;

The average cost of bariatric surgery is between $17,000 and $26,000, according to the american society for metabolic and bariatric surgery (asmbs). How to appeal a health insurance company denial. Here are some of the key requirements for this coverage.

Check with your insurance provider on plan specifics. Insurance is typically the best way to go when you are. Does insurance cover bariatric surgery?

Without health insurance, weight loss. You need to meet requirements and deemed severely obese. However, even if you are in the united states, i can’t give you a straightforward answer.

Be aware it’s not cheap; If you have health insurance and are looking for assistance in determining eligibility and requirements, please reach out to us, as we are happy to help you. Being at least 18 years of age being diagnosed morbidly obese for a certain amount of time before surgery

Our office participates with many insurance plans. Typically, insurance policies do not cover any experimental procedures such as duodenal switches and mini gastric bypass. Should i use insurance or cash to pay for surgery?

Other countries have different rules and requirements, so it may not apply to you. Yes, it some cases weight loss surgery is covered by insurance. Did you know that most lap band(r) and gastric bypass cases are covered by insurance?

You should be prepared to answer some common questions including the following: After weight loss, you might need to maintain it. Payment & insurance coverage for weight loss surgery.

However, if you are considering this weight loss procedure it is important that you reach out to your insurance provider directly. Medicaid covers weight loss surgery (but not all surgeons accept medicaid) if your insurance policy covers weight loss surgery, insurance will only pay for it if: Yes, medicaid covers surgery in most states.

At the same time, the state laws related to weight loss surgery insurance coverage will also apply according to the state where you reside and work. In the case of primary bariatric surgery as well as revision weight loss procedure, which were once considered as purely elective surgeries, the insurance companies are gradually willing to change their position. Ideally, fluctuations could interfere with the outcome of the procedure.

It is the last resort for people that have tried many ways to lose weight but can’t. Lose at least 100 pounds. Our insurance experts are well versed in working with most major insurance companies.

How much is skin removal surgery, exactly? At this point, you are an excellent candidate for a body lift. The answer is yes, subject to your eligibility for the bcbs federal employees program.

Why is the balloon not covered by insurance? Be over the age of 18 have a bmi of 40 or greater, or have a bmi of 35 or greater with a comorbidity such as diabetes or hypertension The cheapest policies start from $159 per month.

Your insurer can offer partial coverage for your skin removal surgery if you lose at least 100 pounds. In many cases, the answer is yes! Only a few years ago the lap band procedure was considered experimental and not covered by most insurance companies.

We can help you determine the scope of your insurance benefits and coverage as well as help you meet any bariatric surgery qualifying requirements your insurance company may have. Does medicaid cover weight loss surgery? The information presented in this post is for patients in the united states.

The orbera balloon is not currently known to be covered by any insurance plan. Some of the requirements for weight loss procedures covered by insurance, such as bariatric surgery, include: Weight loss surgery costs, insurance coverage bariatric surgery is one of the most popular methods for managing weight loss for individuals that are considered obese.

Is weight loss surgery covered by insurance? You will need to build a strong case that your surgery is medically necessary, however. Weight loss surgery is predominantly performed on middle to upper class patients.

If your health insurer denies the request for weight loss surgery, you can appeal the decision. However, today, insurance companies are starting to cover weight loss surgery more than ever. Come to one of our free weight loss seminars hosted by our expert bariatric surgeons.

Insurers increasingly recognize that obesity is a progressive disease, and surgery or a revision procedure can provide a viable medical solution. Today most insurance companies that cover weight loss surgery will cover gastric bands, laparoscopic gastric bypass, and gastric sleeve surgery. Health insurance policies will cover bariatric procedures when there is medical necessity.

After you have completed all of the steps to prepare for weight loss surgery, our staff at nyu langone’s weight management program is able to discuss payment options. The reason for the question is it’s one of the biggest concerns that we hear from people who are thinking about the lap band(r) or gastric bypass and it can be a deciding factor in moving forward with the procedure. These are the general baseline costs for the most common plastic surgeries to loose skin after weight loss, according to the american society of plastic surgeons:

But today, more than ever, insurance companies are starting to cover weight loss surgery. You must have attained the age of 18. According to duke health, you will likely have to meet some or all of the following criteria in order to get weight loss surgery covered by your insurance: